How Small Business Works and Why They're Essential [Ultimate Guide]

by Eric Lam - Published 10/18/2023

by Eric Lam - Published 10/18/2023

A small business is a privately-owned company that operates on a much smaller scale compared to larger corporations. While the definition varies depending on the country, industry, and government regulations, small businesses and solopreneurs often have a limited number of employees and generate less annual revenue. In the United States, for example, the Small Business Administration (SBA) considers a business small if it has fewer than 500 employees and less than $7 million in annual receipts.

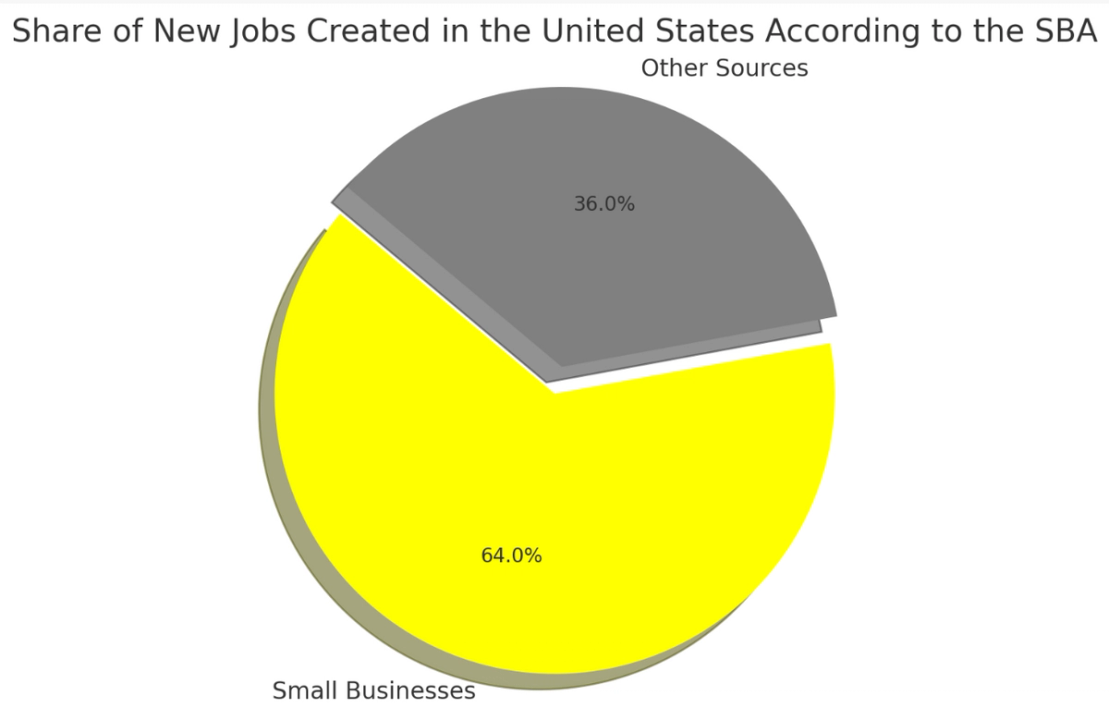

But don't let the word "small" mislead you. Small businesses play an enormous role in economic growth and job creation. They are the backbone of many economies worldwide, serving as incubators for innovation and providing opportunities for entrepreneurs to bring their ideas to life. Moreover, they create a substantial amount of jobs, contributing significantly to the employment rate. According to the SBA, small businesses account for about 64% of new jobs created in the United States.

Small businesses are especially important in local economies. They provide essential goods and services to local communities, often with a personalized touch that larger corporations can't replicate. They are more agile, able to adapt quickly to market changes and customer demands. Plus, they often put money back into their communities by using local resources, from labor to materials and services, which contributes to local development and community building.

They're not just businesses; they are neighbors, friends, and community builders. From your local coffee shop to the small tech firm downtown, each has a story, a mission, and a vision that reflects the spirit of entrepreneurship. This intimate connection to the community and focus on localized services often results in strong customer loyalty, which is critical for their long-term success.

So, while small businesses may not generate as much money as large corporations, their importance in economic growth, innovation, and job creation is indisputable.

Types of Small Businesses

Small businesses are incredibly diverse, offering various services and products, often adapting to market needs and consumer demand. Examples include brick-and-mortar establishments like restaurants and retail stores, as well as digital platforms such as e-commerce websites.

Brick-and-Mortar Businesses

Restaurants and retail stores are quintessential examples of small businesses that serve local communities. These establishments focus on providing goods and services to consumers in specific geographical locations. Restaurants, for instance, may establish a reputation for their unique cuisine or atmosphere, attracting both local residents and tourists. Retail stores, from clothing boutiques to electronics shops, cater to the diverse needs of their potential customers. The property manager often plays a crucial role in these types of businesses, overseeing operations and ensuring everything runs smoothly.

E-commerce Businesses

The rise of online commerce has paved the way for small business owners to expand their reach and tap into markets that were previously out of reach. An e-commerce website can be an excellent platform for reaching new customers and increasing market share, all without the overhead costs associated with maintaining a physical location. Operating an online business offers the advantage of 24/7 availability, expanding the potential for sales and allowing the business to serve a broader range of customers.

Hybrid Models

Many businesses adopt a hybrid model, combining a physical store with an online presence. This dual approach allows businesses to capture a larger audience, catering to those who prefer in-store experiences and those who favor the convenience of online shopping. For these businesses, marketing plays a crucial role, both in advertising online and connecting with local chambers for community events to raise awareness of their brand.

Incorporating Technology

Technology serves as a linchpin for both brick-and-mortar and e-commerce businesses. For instance, point-of-sale systems in retail stores have evolved to provide more than just transactional functions; they now offer inventory management and data analytics to help business owners make informed decisions. In e-commerce, technology allows for secure payment processes, efficient customer service, and a user-friendly site interface, making it easier for new clients and potential customers to navigate and make purchases.

By embracing technology, small businesses not only become more efficient but also gain a competitive edge in their respective markets. Ignoring the benefits of technology can be detrimental to a business's success.

Scope, Scale, and Local Impact of Small Businesses

When we look at the scope and scale of small businesses, it's evident that they operate on a much smaller scale compared to larger corporations. Revenue is generally limited, and the number of employees can range from just a handful to a few dozen, or even up to 500 based on certain industry definitions by organizations like the Small Business Administration.

Limited Revenue

The term "limited revenue" shouldn't be misconstrued as a sign of failure or inadequacy. Small businesses are generally more agile, allowing them to operate efficiently even with lesser capital. This resourcefulness is often an important factor that helps them maintain market share in local or specialized markets.

Serving Local Communities

One of the most distinguishing features of many small businesses is their focus on local communities. Unlike large corporations that aim for a broad, often international market, small businesses thrive on local demand. Whether it's a local bakery, a neighborhood gym, or a regional accounting firm, these businesses offer products and services tailored to the needs and preferences of the community they serve.

Fewer Employees but Greater Job Creation Impact

Don't let the term "fewer employees" mislead you into underestimating the role of small businesses in job creation. According to various statistics, small businesses are responsible for generating a significant portion of new jobs. The fewer employees often mean a close-knit work environment, where each person usually has a diverse range of responsibilities, providing them with a broad skill set and a more enriched job experience.

Community Involvement and Relationships

Small businesses often establish deep roots in their communities. Owners and employees alike frequently engage in local events, contribute to local charities, and may even collaborate with local chambers to contribute to community development. This community focus not only builds trust but also fosters a network of mutual support among other small businesses and local organizations.

By operating on a smaller scale and focusing on local communities, small businesses create a unique blend of personalized service and community engagement. This is a far cry from the impersonal nature of larger corporations, making small businesses an invaluable part of any community.

Ownership Structures in Small Businesses

When it comes to the ownership of small businesses, there are several options available that directly affect the way the business operates, particularly in terms of taxes, liability, and other legal aspects. Let's delve into the most common types of ownership structures: sole proprietorship, partnership, and Limited Liability Company (LLC).

Sole Proprietorship

The simplest form of business structure is a sole proprietorship. Here, the business and the owner are essentially the same entity for tax and liability purposes. While this allows for streamlined decision-making and complete control for the owner, it also means that the owner is personally responsible for the debts and liabilities of the business. This is often a preferred option for freelancers and those running very small operations where the risks of business liabilities are relatively low.

Partnership

In a partnership, two or more people share ownership of the business. This structure allows for more potential for resources in terms of capital and skills. Profits and losses are typically divided among the partners based on the terms of the partnership agreement. Like a sole proprietorship, partners are personally responsible for the business's debts and legal liabilities. However, certain types of partnerships, like limited partnerships (LP), can allow for some partners to have limited liability.

Limited Liability Company (LLC)

An LLC provides a flexible option for small business owners. While offering limited liability, similar to larger corporations, it also allows for flexible tax reporting options. It's a popular choice for small business owners who expect to expand their business and potentially seek funding from outside investors. The structure is often recommended for businesses that provide services that may expose them to legal liability. The paperwork for creating an LLC is often straightforward, but it's always a good idea to seek advice from professionals familiar with business laws and taxes in your country and state.

Impact on Taxes, Liability, and Legal Framework

Choosing the right ownership structure is crucial because it affects your taxes, liability, and other legal obligations. A sole proprietorship might be the simplest form but comes with unlimited personal liability. Partnerships add the complexity of shared responsibility but can also mean shared liability unless you opt for a form like the Limited Partnership. LLCs offer a middle ground by protecting personal assets while offering tax benefits.

Future Development and Funding Options

Your choice of business structure can also affect your ability to raise money for development or expansion. For instance, it might be easier to secure funding as an LLC because of its more rigid structure and investor-friendly setup. Entrepreneurs with plans for scaling up often opt for this.

Decision-making and Operational Control

Sole proprietorships and partnerships often allow for more straightforward decision-making processes, given the fewer number of people involved. LLCs, depending on how they are structured, may require more formal processes for decision-making, affecting the company's agility.

The Importance of Business Licenses and Understanding Tax Obligations

When you're setting up a small business, getting the right business license is a critical step. Operating without a proper license can expose you to legal troubles, hindering your business' success and even leading to its closure. The requirements for a business license vary by country, state, and sometimes even by the city. It's important to consult local chambers of commerce or other business organizations to get accurate and up-to-date information on this.

Types of Business Licenses

The kind of business license you'll need often depends on the type of services or products you offer. For instance, a property manager might require a different set of licenses compared to a restaurant owner. Some businesses may even require multiple licenses to operate legally. Make sure you check the specific requirements related to your industry to avoid any legal complications.

Tax Obligations and Business Structures

Your tax obligations aren't just dictated by your revenue; they also depend on your business structure. Sole proprietorships, partnerships, and LLCs each have distinct tax implications. Tax codes can be complicated, and understanding your tax obligations is essential for financial planning and for avoiding legal issues.

For instance, if you have an LLC, you might have more flexible tax options, but there could also be additional forms and compliance requirements. In contrast, a sole proprietorship usually involves simpler tax filing but with fewer opportunities for tax benefits.

Revenue Impact on Taxes

In many countries, the amount of revenue your small business generates determines not only the amount of tax you pay but also the specific forms you'll need to submit. Understanding the tax brackets and potential deductions available to you is crucial for optimizing your tax liability.

Additional Obligations and Resources

Your tax obligations may also include additional duties like sales tax collection and employee withholdings if you hire employees. In many cases, online resources and software can assist with tax compliance, but it's often beneficial to consult a professional for personalized advice tailored to your specific circumstances.

Advantages of Small Businesses: Flexibility and Local Impact

Small businesses come with a unique set of advantages that set them apart from larger corporations. Understanding these strengths can not only help small business owners maximize their potential but also make them more competitive in the market.

The Flexibility Factor

One of the most striking advantages of a small business is its flexibility. Unlike larger companies with rigid hierarchical structures, small businesses can adapt quickly to market changes, consumer preferences, and emerging trends. Because decision-making processes are typically more streamlined, small businesses can pivot their strategies much faster. This flexibility is particularly useful in turbulent economic times or when responding to unforeseen events.

Quick Decision-making and Operational Control

The flexibility of small businesses often translates into quicker decision-making. Whether it's about launching a new product, entering new markets, or implementing a business plan, the absence of bureaucratic delays allows for rapid execution. This operational control can be a significant advantage in industries where market conditions are continuously evolving.

Impact on Local Economies

The influence of small businesses on local economies is profound. They often serve as the backbone of local communities, offering employment opportunities and keeping money circulating locally. By spending revenues on local services, resources, and employees, they contribute directly to local development and community well-being.

Community and Customer Relationships

Small businesses often have the advantage of building strong community and customer relationships. The direct interaction between business owners and customers allows for personalized service and fosters customer loyalty. These relationships can be crucial in gaining market share and achieving business success.

Cost Advantages

Many small businesses operate on a lower-cost model than larger companies. Without the overhead of large office spaces, hefty executive salaries, and layers of staff to manage, small businesses can often deliver quality products or services more cost-effectively, attracting cost-conscious consumers.

Challenges Faced by Small Businesses

While small businesses have unique strengths, they also face several challenges that can impede their growth and sustainability. Addressing these issues effectively is crucial for long-term success.

Resource Limitations

One of the most significant challenges for many small businesses is the limitation of resources. Unlike larger companies with deeper pockets, small businesses often operate on tight budgets. This financial constraint affects various aspects of the business, from marketing and advertising to hiring skilled employees. Even aspects like technology and development can be impacted due to limited funding.

Lack of Specialized Staff

Another consequence of resource limitations is the lack of specialized staff. Small businesses often can't afford to hire experts for different departments like larger companies can. Instead, a few employees or even the small business owner may have to wear multiple hats, leading to the risk of spreading oneself too thin.

Competition from Larger Companies

Small businesses face stiff competition from larger companies that have the advantage of scale, market share, and brand recognition. Big businesses can undercut prices, offer more extensive services, and invest more in marketing and advertising, making it tough for small businesses to compete effectively.

Limited Market Access

Compared to larger corporations with extensive networks and industry connections, small businesses often have limited access to markets. Even with a great business plan, the lack of market access can be a considerable barrier to growth.

Lack of Business Experience

For new business owners, especially those without a bachelor's degree or a high school diploma in business, a lack of experience can be a significant challenge. Many businesses fail because their owners lack the necessary skills to manage finances, plan strategically, or handle other critical business operations.

Navigating Legal and Regulatory Requirements

Understanding and complying with legal obligations like tax codes, business licenses, and employee benefits can be complex and time-consuming. This is especially challenging when you're focused on other important factors like gaining new clients and customers.

Funding Small Businesses: Personal Funds, Bank Loans, and Grants

Navigating the financial landscape is a critical component of running a small business. Whether you're in the initial stages or looking to expand, understanding your funding options can make a significant difference in your business's trajectory.

Personal Funds

Many small business owners start their journey by dipping into personal savings or using personal credit cards to cover initial costs. While this approach offers the most control and the quickest access to funds, it comes with its own set of challenges. Using personal funds can be risky, as it ties your financial well-being directly to the success of the business. But if you're confident about your business plan and market to potential clients, it can be a viable route.

Bank Loans

Bank loans are another common funding source. These usually offer more substantial amounts and potentially lower interest rates than personal credit cards. However, qualifying for a bank loan requires a strong business plan, good personal and business credit, and often, some form of collateral. Bank loans allow small business owners to maintain full ownership of their company while also having the cash needed for operations or expansion.

Grants

Small business grants are essentially free money but are usually highly competitive. These grants can come from various sources, including the government, private organizations, and community groups. The Small Business Administration (SBA) is one such source that offers grants targeted at specific industries and demographics, such as black entrepreneurs or businesses focused on research and development. Grants can provide the necessary capital without the pressure of repayment, allowing businesses to focus on growth.

Crowdfunding and Investors

Crowdfunding platforms like Kickstarter and Indiegogo have become increasingly popular. These platforms allow businesses to raise small amounts of money from a large number of people. Another option is to seek private investors or venture capital, although this often means giving up some level of ownership and control.

Strategic Partnerships

Forming strategic partnerships can be an alternative way to secure funding. Partnering with another business in a related industry can provide not only financial resources but also access to a broader customer base and market share.

Marketing in Small Business: Digital vs. Traditional Strategies

In the fast-paced business landscape, marketing is the linchpin that can make or break a small business. From attracting new customers to retaining existing ones, effective marketing is essential. However, the methods can vary drastically between digital and traditional formats, each with its unique advantages and challenges.

Digital Marketing: SEO and Social Media

Search Engine Optimization (SEO) is a crucial aspect of digital marketing. When executed well, it can significantly increase online visibility. Small businesses can optimize their websites and content to rank higher in search engine results, drawing more organic traffic. SEO can be a cost-effective way to gain new clients and build brand awareness online.

In the era of social media, platforms like Facebook, Instagram, and Twitter offer small businesses a chance to engage with potential customers directly. Social media marketing not only builds brand awareness but also fosters community around your products or services. It's a way to show off your industry expertise, share success stories, and announce new offerings or events.

Traditional Marketing: Flyers and Local Advertising

Despite the digital revolution, traditional marketing methods like flyers and local advertising still have their place, especially for small businesses that serve local communities. Flyers can be distributed in strategic locations, like local chambers of commerce or community boards. They're generally inexpensive and can produce immediate local awareness.

Local advertising, whether through print media or local TV stations, can also be effective. The costs are usually higher than digital methods but can offer a different type of exposure. Such advertising methods are excellent for reaching an older demographic that might not be online as often.

Hybrid Approaches

Many businesses find that a combination of digital and traditional marketing works best. For example, using social media to promote an event and then distributing flyers at the event itself can create a synergy that maximizes reach.

Measuring Success

Both digital and traditional marketing methods come with tools for measuring success. Online, analytics software can give you real-time data on customer engagement, while traditional methods may require customer surveys or tracking the source of new business manually.

The Future of Small Businesses

As we move further into the digital age, trends indicate that small businesses are likely to experience a considerable shift in operational dynamics. Two key trends steering this change are the adoption of remote work setups and the increased use of technology in various business aspects.

Remote Work: A New Normal

While remote work has been on the rise for some time, the trend has significantly accelerated recently. For small businesses, this offers an excellent opportunity to cut costs related to physical office space. Furthermore, remote work opens up a global talent pool, offering small business owners access to skilled employees that they might not have been able to attract otherwise. This could be especially beneficial for small businesses in specialized industries where local talent is scarce.

However, remote work is not without its challenges. The lack of a physical office could lead to decreased team cohesion and collaboration. To combat this, many small businesses are turning to digital tools for team building and project management. Software like Slack or Microsoft Teams allows team members to communicate more effectively, irrespective of their location, enhancing job satisfaction and productivity.

Technological Advances: Not Just for Big Players

Technology isn't solely the domain of large corporations. Today, small businesses also have access to an array of technological tools that can drastically improve operations and customer engagement. Whether it's employing AI-based chatbots for customer service or using advanced data analytics tools for market research, technology is levelling the playing field.

This adoption of technology extends beyond product or service offerings and into the realm of internal operations. For example, modern software can automate various administrative tasks like payroll, invoicing, or even certain aspects of human resources, freeing up time and resources for small business owners to focus on strategic growth.

Embracing the Future

For small businesses to stay competitive, embracing these emerging trends is not just advisable but crucial. The integration of remote work setups and advanced technologies can offer enhanced flexibility, cost savings, and a broader market reach. By being proactive and adaptive, small businesses can better position themselves for future success in an ever-changing business landscape.

How to Start a Small Business: A Simplified Guide

Embarking on the journey to start your own business can be an exhilarating yet daunting experience. However, having a well-thought-out business plan can make the process smoother and more manageable. Let's break down these foundational steps to starting your own small business.

Crafting a Solid Business Plan

Before diving headfirst into buying or starting your new venture, it's essential to formulate a robust business plan. This document should outline your business objectives, target market, competitive landscape, financial projections, and marketing strategies. In essence, a business plan serves as a roadmap, guiding you through each stage of starting and running your business.

One of the important factors to consider in your business plan is the type of business structure best suited for your venture. Whether it's a sole proprietorship, partnership, or LLC, each structure has implications on taxes, liability, and other legal aspects. Consulting with professionals in these areas can offer invaluable advice.

Securing Funding

After finalizing your business plan, the next significant hurdle is securing the necessary funding to get your small business off the ground. Many small business owners use a combination of personal funds, bank loans, and grants. Online platforms can also be an avenue for crowdfunding. Your choice of funding will largely depend on your business needs, the risks involved, and your financial standing.

Kickstarting Operations

With a business plan and funding in hand, you're almost ready to kickstart your operations. However, there's still some groundwork to do. Firstly, you'll need to register your small business and secure the necessary licenses or permits. Tax obligations will also come into play, and they vary depending on your business structure and expected revenue. Utilizing accounting software or hiring a professional can help manage these fiscal responsibilities.

Open for Business

Once the administrative aspects are sorted, it's time to open your doors, either literally or figuratively, to your potential customers. Whether your small business offers products, services, or operates online, your initial days should focus on quality and customer service to build a loyal customer base.

Conclusion

Small businesses are critical to economic development and offer both challenges and opportunities for owners and communities. If you're ready to get setup, learn what you could sell to get started.

FAQs

- What differentiates a small business from a startup?

A small business often focuses on generating steady revenue and serving a local market. A startup, on the other hand, aims for rapid growth and scaling, sometimes without immediate profitability. - How many employees do small businesses typically have?

The number varies depending on the country and industry. In the United States, for instance, a small business can have up to 500 employees according to the Small Business Administration. - Is government registration necessary for a small business?

Yes, you usually need to register with the appropriate government bodies. This often involves getting a business license and registering for tax purposes. - What are common funding sources for small businesses?

Common sources include personal savings, bank loans, and grants. Some small businesses also raise money from friends and family or venture capitalists. - How can technology benefit a small business?

Technology can streamline operations, improve customer service, and enhance productivity. Tools like accounting software, customer relationship management (CRM) systems, and e-commerce platforms are often used.